Not so long ago, the limited liability company (LLC) was a new kind of legal structure available for small businesses. At that time, LLCs were like the new kid on the block amongst all the other business entities. Since then, it hasn’t just made a place in the market, but has become one of the most popular business entities used by business owners due to its flexibility and liability protection.

Let’s say that you started a small business and ran into some legal issues or got into a huge debt. The liability protection of an LLC would make sure that your personal belongings like your car and house are safe. All the debt will be paid using the business assets only. Without the liability protection, you might end up losing everything you have including the company and the shirt off your back.

Now, you might be thinking that all this just sounds the same as a corporation. And, you are right, to a point. But there are some other things that the LLC offers that a corporation does not, particularly its flexibility. In this post, we will deep-dive into what an LLC is, and how it is a great business entity choice for your business.

What is a Limited Liability Company?

Just like a corporation, a limited liability company is a legal entity separate from its owners. An LLC can easily get its own tax identification number, do business, and even open its own checking account. It is a simple and highly versatile company structure as compared to S-corps and C-corps. In short, it is a legal entity similar to the combination of the following:

- Corporation in its liability protection

- Partnership/Sole proprietorship in its taxation

The owners of an LLC are called members and every member of the LLC has liability protection. Generally speaking, there can be an unlimited number of members and anyone can be a member of an LLC, including:

- Other LLCs

- Corporations

- Trusts

- Partners

- Individuals

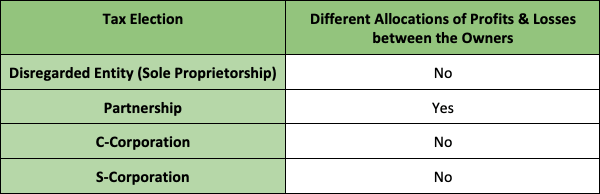

An LLC can be opened in any state. The profits and losses of the company can easily be divided differently among the various entity designations. This means that the LLC members can distribute the earnings using any method they want, unlike s-corporations. In addition to this, limited liability companies do not have to worry about much of the standard documentation that the other corporations have to complete to stay compliant, including shareholder meeting minutes, annual director meetings, and other formalities.

How are LLCs Taxed?

One of the main benefits of starting an LLC is that you get a lot of tax flexibility and benefits. By default, the LLC is taxed as a pass-through entity. This means that it can avoid the double taxation issue that C-corps have, so that the income tax is only paid at the personal level by the members on their personal income tax returns for the earnings made in the company.

Another tax benefit is that the LLC members can easily claim their own share of loss in the business on their income taxes. This is something great for those who have just started up as it helps in saving a lot of tax. But to be able to gain these benefits, you will have to choose to be taxed as an S-corp, which is one of the four tax classifications available for an LLC.

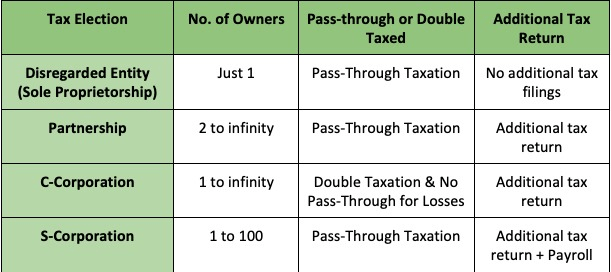

The four tax classifications available to LLCs include: C-corporation, S-corporation, partnership, or disregarded entity (sole proprietorship). Before we can talk about each, you need to know that electing to be taxed as an S-corporation might not be the best choice for your company. You will need to choose the best method that suits your business and its needs. The best way to get around this is by taking the help of a tax lawyer and a business attorney while electing on how you want your LLC to be taxed.

With this said, let us now look into the differences in each tax classification with the help of the table below:

From the table, if you elect to be taxed as a:

- Disregarded Entity: You can have only one owner of the company and enjoy the pass-through taxation. This means that the company’s earnings would be taxed at the personal level where the owner would report about the profits or losses in their personal income tax returns and pay for the tax on it there. Under this, there are no additional tax filings. In short, you will get the limited liability protection and still be a sole proprietor with the least amount of complications under this tax classification.

- Partnerships: Here, you can have from two to an infinite number of owners in the company. And since partnerships are also pass-through entities, all the gains and losses would be pass-through and reported in the personal income tax returns of the owners. The rest is the same - you would not have complications and will still be enjoying the limited liability protection since it is an LLC.

- C-Corporations: You can also be taxed as a C-corporation where you can have any number of owners. But just like C-corporations, you will have to pay the tax twice on the earnings made from the company—once at the corporate level and once at the personal level, which is called double taxation. Along with this, you cannot report any pass-through losses under this election.

- S-Corporations: Often when a professional practice or consulting small business, like doctors, engineers, accountants, and lawyers, it elects to be taxed as an S-corporation. With this tax election, a company is allowed to have 1 to 100 owners (who must be individuals) and the profits and losses pass-through to the owners who then report them in their personal income tax return. This option also offers additional tax benefits, like lower self-employment and payroll tax.

By default, the federal government taxes a single-owner LLC as a disregarded entity and a multi-owner LLC as a partnership. To get the benefits of being taxed as a C-corporation or an S-corporation, you will have to file for the election using the Form 8832 with the Internal Revenue Service.

Note: Before you make a tax election, you should consult an experienced tax lawyer and your CPA. They will help you make the right choice based on your business plans and future.

Advantages of LLCs

There are a lot of advantages of an LLC, these include:

- Limited Liability Protection: As shared above as well, an LLC’s main advantage is that it offers limited liability protection to the owners. This means that only the business is responsible for the debts and liabilities that it incurs and not the members of the LLC.

- Enhanced Credibility: With an LLC behind your company name, people recognize your company as genuine, making it easier to get suppliers, vendors, and even investors.

- Flexible Profit Distribution: Limited liability companies can easily select the way they want to distribute the profit among themselves.

- No Residency Requirements:

The members of the LLC are not required to be US citizens or a permanent resident here in the USA. This means that a foreigner can easily open an LLC here. But before you do that, consult a business attorney and a tax lawyer to help you make the process smooth.

- Management & Control Flexibility: LLCs offer the flexibility in choosing how you want the company to be structured. There are usually two kinds of structures you can choose from:

- Member-Managed: Any member in the company, regardless of how much of the company they own, can easily sign and bind any contract/document of the company. Let us take an example to understand this - there are 5 owners in the company named Tony, Larry, Mike, Dorothy, and Eliot. Tony owns 35% of the company, Larry owns 25%, Mike owns 20%, Dorothy owns 15% and Eliot owns just 5% of the company. Now, let us say that a very important contract or document is given to Eliot since the other owners are not available, he can easily sign the document as per his choice and bind it. This is even though he has just a small ownership of the company and technically, shouldn’t have so much control over it. Although this can be a good thing for some groups, a lot of people do not find it wise to allow a minority member sign contracts on behalf of the whole company. This is one reason why many corporate attorneys advise to avoid creating this kind of structure.

- Manager-Managed: In a manager-managed LLC, the company can appoint its managers to manage the company separate from the owners. These managers (or manager) have the rights to sign on any company documents and contracts and bind the company accordingly. It allows to separate ownership from management of the Company.

- Minimal Compliance Requirements: Where corporations are required to have annual meetings, record the minutes of the meetings, create bylaws, etc., the LLC does not have such requirements. Compliance with entity formalities are much simpler for an LLC.

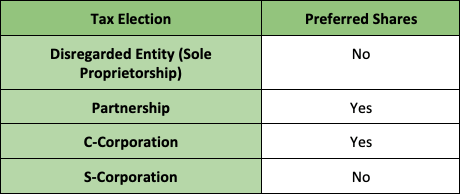

The above advantages are the same regardless of the tax classification made for your LLC. But it should be kept in mind that the tax classification election you make will dictate if your company is allowed to enjoy some additional benefits or not, other than those mentioned above. Each of these benefits have been explained in the below table:

#1 Equity Flexibility

#2 Pass-Through Profits & Losses

Disadvantages of LLCs

Just like everything, LLCs come with some trade-offs. These include:

- Self-employment taxes: An owner of an LLC taxed as either a partnership or disregarded entity will pay self-employment taxes on all profits of the business.

- Owners Cannot be Employees: If you are the owner of an LLC taxed as either a partnership or disregarded entity, you cannot be an employee of your LLC because you are considered a self-employed owner.

- Not Attractive to VCs: Due to some tax issues, an LLC taxed as either a partnership or disregarded entity is not considered to be “ideal” for many venture capitalist investors or other institutional investors. Although some are beginning to invest in LLCs, it is still not considered to be ideal by many. This can turn out to be a disadvantage if you are hoping to raise outside funds from venture capital funds or other institutional investors.

Who Can Form an LLC?

Many small business owners choose to open an LLC due to its flexibility, versatile taxation methods, and the many benefits that it comes with. So, the LLC structure is can be perfect for all kinds of businesses including professional practitioners, real estate companies, retail companies, e-commerce businesses, technology companies, etc.

But at the end of the day, choosing the LLC as your business entity would depend on how you see your business growing and progressing in the future and what you want it to do. The best way around the decision is by taking the help of an experienced business attorney and tax lawyer.

Freeman Lovell LLC offers these services and can help you make your choice. All you need to do is contact us and let us know about your business plan. Based on this, we will guide you in making the right choice. Feel free to reach out to me at josh@freemanlovell.com or text us at (385) 217-5611 to learn more!