The fact that you are reading this means that you are an entrepreneur, business owner, or planning to become one. You are our heroes and we applaud you for taking on this journey and challenge. One of the most important things that you can do in starting a business is properly being able to control your cap table. And controlling your cap table will enable you to have a business that can grow and scale.

What is a Cap Table

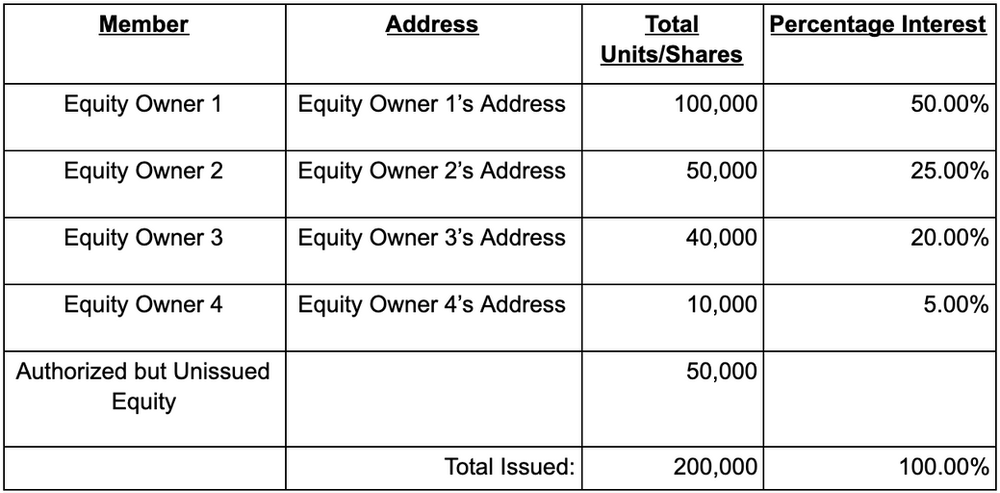

So first off, a cap table is the list of owners of equity in your business and how much equity you have reserved to sell or grant in the future to additional owners, including employees or investors. Here’s a visual example of what a cap table looks like:

How to Control Your Cap Table

What does it mean to “control” your cap table? With an Operating or Shareholder Agreement, there are two different philosophies that are in tension in each. On one hand, you can err on the side of protecting the company, and on the other, you can err on the side of protecting the owners.

I often see owners make the mistake of erring on the side of protecting the owners in a way that lays roadblocks in front of the business when it tries to grow and scale. Anti-dilution clauses and requiring unanimous consent from owners to authorize and issue new equity are the most common ways people stumble when trying to grow a business. In my professional opinion, I would trade an anti-dilution provision for preemptive rights, and unanimous approval for supermajority consent and good faith requirements.

What to Include in Your Operating Agreement or Shareholder Agreement

Now that you have a business that you want to scale, and you want the company to control the cap table instead of having an owner-controlled cap table, what’s next? Here are 5 items that you should consider when preparing your Operating or Shareholder Agreement:

- Pick the right equity splits and use vesting even for founders

- Include Buy-Sell provisions

- Rights of First Refusal

- For-Cause Repurchase Rights

- Drag-Along Rights

Provisions to Avoid in Your Operating Agreement or Shareholder Agreement

Not only are there some provisions you should include in the Operating Agreement of Shareholder Agreement, but there are some you should avoid. Here are 2 provisions (that we briefly mentioned previously) you should keep out and not allow in your Operating Agreement or Shareholder Agreement:

- Anti-Dilution

- Unanimous Consent

What to Include

Equity Splits and Vesting

With the right provisions in your Operating Agreement or Shareholders Agreement, you need to consider how to split and allocate the company’s equity. When determining how much equity to give co-founders, employees, or other owners, you should take into consideration a number of factors:

- The potential value of the idea and concept of the business;

- The value or actual cash and property contributed by the owners; and

- The value over time for relationship and service values to be provided.

One thing to remember is that the equity associated with items 1 and 2 should be fully vested, but any value attributed to item 3 should be protected and incentivized to be earned through vesting provisions.

Buy-Sell Provisions

Buy-sell provisions typically give the company a repurchase right if equity ownership changes hands due to one of the following events:

- Death

- Disability

- Divorce

- Bankruptcy

A well-drafted buy-sell provision will put the business in a position to avoid ownership disputes with heirs, individuals with powers of attorney, ex-spouses, bankruptcy trustees, and estates, who may have very different motivations and desires for the business then your intended partner.

Rights of First Refusal

A well-drafted right of first refusal will protect the business from allowing an owner from selling its interest to a third-party without the consent, approval, and right of the company or other current owners to buy that interest first. This is important so that a controlling interest is not sold to a competitor or other party who may have a different vision for the future of the business, which could lead to division and distraction in working through these issues.

For-Cause Repurchase Rights

One of the ugly places a business can find itself in is having a major equity holder engage in an activity that seriously hurts the business, its reputation, or its future prospects and then having to continue to pay that person as the other business owners rebuild the business through their own efforts, fixing another partner’s damage. A properly drafted, for-cause repurchase right will allow a company to repurchase the equity of such a bad-actor partner at a value that takes into account the damage that partner did to the business.

Drag-Along Rights

Another bad place a business can find itself in is having a minority owner holding back a major transaction. One way that this can happen is in the event of an equity sale of the business. In an equity sale of a business, it is necessary to have all equity owners be required to sell and transfer their individually-owned equity in the business. Without a drag-along provision, you could find yourself in a position where an owner of less than 1% of your business could stop the ability to complete an equity sale, forcing you to do an asset sale of the business instead which could have far-reaching tax consequences.

What to Avoid

Anti-Dilution Clauses

This is a provision you should avoid as if your life depended on it, except for in very limited exceptions. An anti-dilution provision is a provision that says that a certain owner’s ownership percentage cannot dilute below a certain percentage of equity in a company. This becomes a huge problem as a company grows and scales. The difference between 5% of an early-stage company with limited value and 5% of a company on the verge of going public is huge. These situations also come with significant tax implications when new equity has to be granted without additional compensation. If someone says they want anti-dilution, say no and offer them a preemptive right to be able to purchase an amount of any future round of financing at the same terms and conditions as future investors.

Unanimous Consent

I’m always very concerned about unanimous consent provisions in an operating agreement or shareholder agreement. This is because the only partner a unanimous consent requirement protects is the smallest owner. Imagine our government trying to function if one congressman could stop any legislation from passing. It’s important to carefully figure out a supermajority consent or voting structure for your business that avoids deadlock and requires proper approval of business decisions that generally favor the best interests of the business and its owners, but giving the tiniest owner a veto right on the business decisions is a dangerous proposition.

Is this Really that Important? But I Get Along Really Well With My Partners...

As business lawyers, our job is to plan for the worst. One of the things that we hear all of the time is: “I trust my partners and we’ll be able to work things out.” While this may be true in most scenarios, there are a minority of scenarios where this is not the case and the damage leveled in such scenarios can be crippling.

We have witnessed companies in a matter of weeks going from the prospect and commitment for 7 and 8 digit investments to filing for bankruptcy because their operating agreements and shareholder agreements were unbalanced in protecting the owners instead of the business.

Controlling your cap table is critical for the future of your business.

If this all seems like a lot to understand or follow, or you just want a business lawyer to walk you through this process, don’t hesitate to reach out to an experienced business attorney or corporate lawyer at Freeman Lovell. We have the resources, expertise, and experience to guide you through your entrepreneurial journey from idea to exit.

Call or text us at (385) 217-5611 or send us a message through our Contact Form .